Key Takeaways

- Labor Shortage Is Reshaping Operations: A technician gap exceeding 110,000 is extending timelines and raising costs; contractors that invest in training, apprenticeships, and efficiency-boosting tech as well as keep up with HVAC business trends will maintain service quality and margins.

- Refrigerant Transition Creates Risk & Opportunity: New R410A production is banned in 2025 while installs continue through Dec 31; A2L (R-454B/R-32) requires new tools and certifications amid cylinder shortages and 300%+ price spikes.

- Record Demand + Fragile Supply Chains: Housing and commercial growth are driving historic equipment demand; contractors with reliable dealer partnerships (e.g., ACiQ) gain priority inventory, pricing tiers, and technical support to turn volatility into growth.

The HVAC industry is experiencing unprecedented change. Regulatory shifts, supply chain disruptions, and workforce challenges are reshaping how contractors operate and compete. These 2025 HVAC business trends create both obstacles for unprepared and opportunities for forward-thinking contractors.

Three major HVAC industry trends demand immediate attention: a rising labor shortage that’s pushing project timelines and costs higher, the refrigerant transition limiting supply, and record equipment demand straining already vulnerable supply chains. Which contractors survive will depend on their ability to comprehend and adjust to these trends.

HVAC Business Trend #1: HVAC Labor Shortage Creates Contractor Workforce Issues

The Scale of Current HVAC Workforce Issues

The HVAC labor shortage has reached crisis levels, with industry experts reporting a shortage exceeding 110,000 skilled technicians nationwide. This workforce gap isn’t just a temporary challenge—it represents a fundamental shift as experienced technicians retire faster than new workers enter the field.

The aging workforce compounds this problem significantly, creating multiple operational challenges:

- Veteran technicians from the 1980s and 1990s are retiring, taking decades of experience with them

- Fewer young people are choosing HVAC careers despite growing industry demand

- Supply-demand imbalance will persist for years without strategic intervention

- Wage pressure intensifies as contractors compete for limited skilled workers

Contractor workforce issues extend far beyond simple headcount problems. The shortage affects technician quality, with contractors often choosing between hiring under-qualified workers or leaving positions unfilled.

Operational Impact and Market Response

Labor shortages directly impact every aspect of contractor operations. Project timelines extend as fewer technicians handle increased workloads, creating customer satisfaction challenges and cash flow delays. Installation teams work longer hours, increasing fatigue-related errors and safety risks that can damage contractor reputations and increase liability exposure.

Customer service suffers significantly when understaffed businesses struggle to meet service call demands. Emergency repairs take longer to schedule, routine maintenance gets delayed, and customers increasingly turn to competitors who can respond faster. These service gaps damage contractor reputations and reduce customer retention rates.

Smart contractors are implementing comprehensive HVAC labor shortage solutions:

- Investment in training programs and apprenticeship initiatives that develop loyal, skilled workers

- Strategic partnerships with technical schools to create pipelines of qualified candidates

- Technology adoption for efficiency gains that offset labor shortages

- Competitive compensation and benefits packages that build long-term employee loyalty

HVAC Business Trend #2: 2025 R-454B & R-32 Refrigerant Transition Disrupts HVAC Market Trends

Understanding the Regulatory Timeline

The 2025 refrigerant transition officially began January 1st when EPA regulations banned manufacturing of new R410A equipment. However, contractors can still install R410A systems through December 31, 2025, using existing inventory.

This regulatory change creates several key market implications:

- After December 31, 2025, only A2L refrigerants (R-454B, R-32) will be permitted in new installations

- Customers strongly prefer matching existing systems rather than mixing refrigerant types

- R410A has unexpectedly become the most valuable refrigerant during the transition period

A2L refrigerant needs mildly flammable refrigerant handling certification, spark-proof wiring installation, and specialized safety equipment. Contractors must invest in new recovery equipment, updated leak detectors, and obtain EPA certifications—all while managing ongoing supply shortages.

Supply Chain Crisis and Revenue Opportunities

The R-454B shortage has become 2025’s biggest HVAC market trend. Specialized A2L-rated cylinders with pressure relief valves face months-long backlogs, while raw material shortages severely limit production capacity. R-454B cylinder prices have skyrocketed from $345 in 2021 to over $2,000 in 2025—representing more than 300% price growth.

During peak cooling season, many contractors report complete inability to obtain R-454B at any price, leading to significant project delays and customer frustration.

However, the transition period offers contractors multiple strategic revenue opportunities:

- R410A systems command premium pricing due to availability challenges and customer preferences

- Expertise in both R410A and A2L systems positions contractors as trusted technical advisors

- Higher service rates become justifiable through specialized knowledge during customer confusion periods

HVAC Business Trend #3: Record HVAC Equipment Demand Drives Contractor Business Growth

Unprecedented Market Growth Patterns

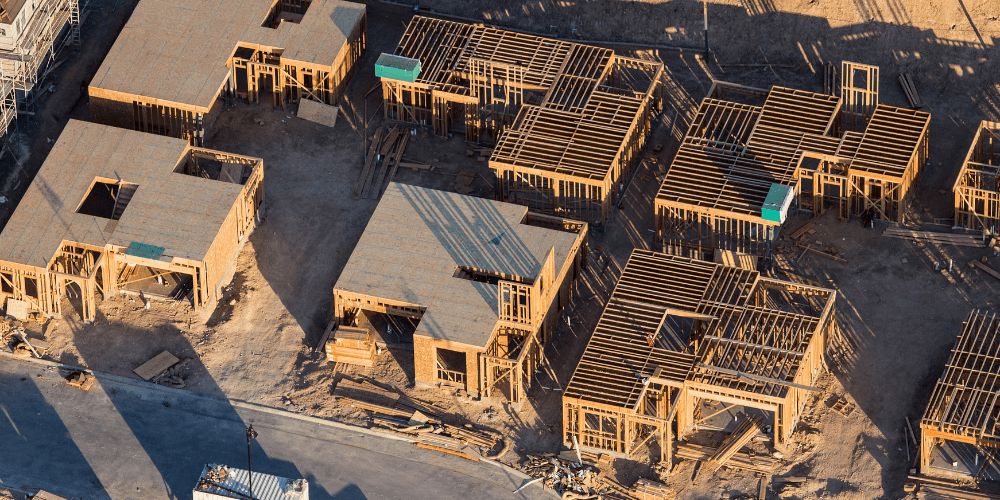

HVAC equipment demand is experiencing historic growth levels, with the industry expanding at 6.9% annually through 2030. Residential construction has reached levels not seen since 2006, with new single-family home construction driving sales growth. Each new home requires a complete HVAC system, creating high demand.

Commercial demand proves equally robust, particularly in data centers requiring specialized cooling systems and multifamily housing projects needing multiple units per building.

This growth creates opportunities for contractor business growth, but only for those who strategically position themselves.

Supply Chain Vulnerabilities and Strategic Responses

Global supply chains face disruption as well. Raw material shortages impact manufacturing capacity, while shipping container access and port congestion create unpredictable delivery delays. International trade policies add ongoing uncertainty to pricing and availability forecasts.

Manufacturing capacity struggles to meet explosive demand growth, particularly for specialized equipment like A2L systems. Component shortages affect multiple equipment types simultaneously, creating cascading delays.

These vulnerabilities particularly impact contractors without established supplier relationships.

How the ACiQ Dealer Program Directly Addresses Each HVAC Business Trend

Comprehensive Solutions for Labor Shortage Challenges

Becoming an ACiQ dealer helps contractors adapt to HVAC industry changes by providing direct access to technical expertise that reduces the burden on limited skilled workers. Our technical support team offers detailed guidance on all ACiQ products, including specifics on compatibility requirements and proper installation procedures.

We also provide support for the refrigerant transition 2025, helping contractors understand both R410A service requirements and A2L safety protocols. Our technical team can guide contractors through complex installations and compatibility questions, significantly reducing project completion time when skilled labor is limited.

Strategic Refrigerant Transition Support

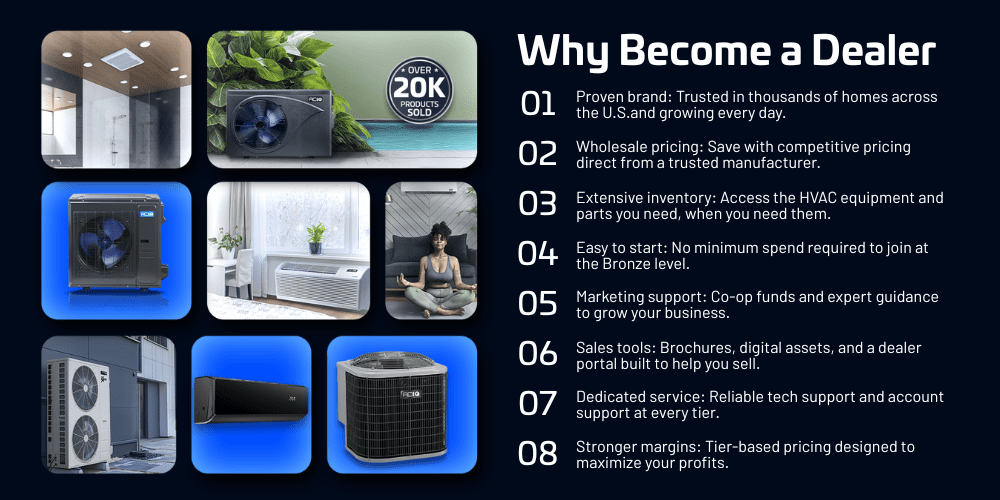

ACiQ’s strategic R410A inventory positioning provides dealers guaranteed access to high-demand systems during the critical transition period. While competitors face persistent supply shortages, ACiQ dealers can quote jobs confidently knowing they can deliver when promised, effectively turning market chaos into sustainable competitive advantage.

Priority allocation ensures dealer orders receive preferential treatment during peak demand periods. Real-time inventory visibility through our comprehensive dealer portal eliminates uncertainty about equipment availability, enabling confident customer commitments that build trust and generate referrals.

Managing Equipment Demand and Supply Constraints

During market expansion periods, professionalism becomes crucial for capturing new customers. The ACiQ Dealer Program provides professionally designed consumer brochures, detailed technical specification sheets, and fully customizable marketing materials that help contractors present professional image without expensive custom design investments.

Free freight programs reduce project costs while improving cash flow management, particularly important during periods of rising equipment prices and ongoing supply chain disruptions. Our Find-a-Dealer website listings actively connect contractors with customers actively seeking ACiQ products, generating qualified leads during market expansion periods.

Co-op advertising funds help contractors expand marketing reach during growth periods, while extended warranty options provide additional selling points that differentiate contractor services and build customer confidence in equipment recommendations.

Strategic Business Positioning for Long-Term Success with the ACiQ Dealer Program

Proactive vs. Reactive Business Strategies

Contractors who wait for market changes to fully develop face significantly higher costs and reduced opportunities. The current market conditions make dealer partnerships more valuable than ever, as independent contractors struggle with supply shortages, price changes, and inventory uncertainty.

Proactive contractors are securing reliable dealer relationships before peak demand hits, ensuring priority inventory allocation when supply constraints inevitably develop. The ACiQ Dealer Program provides guaranteed access to R410A systems during the transition period, competitive pricing tiers that improve with volume, and technical support that reduces project complexity.

Contractors who establish ACiQ dealer status during these transition periods gain preferred inventory allocation, technical support access, and marketing resources that provide ongoing competitive advantages as markets eventually stabilize. Early dealer program participation also positions contractors for tier advancement as their business grows.

Prepare Your Business for the Future of HVAC

These three HVAC business trends every contractor should watch represent both challenges and opportunities for contractors. Success requires proactive adaptation rather than reactive responses to market changes as they develop.

Contractors who secure reliable partnerships for supply, like with ACiQ, and position themselves as market experts will thrive while competitors struggle. The window for strategic positioning is narrowing as market conditions continue evolving rapidly.

Ready to position your business ahead of these critical industry trends? Contact ACiQ today at 1-877-909-ACiQ or visit aciq.com/become-a-dealer to learn how our comprehensive dealer program helps contractors navigate market changes while building sustainable competitive advantages.